We help individuals and businesses achieve clarity in financial decision-making through streamlined financial processes, ensuring efficiency.

Too often companies spend time and money on paying someone to dig through records trying to piece together a sale or purchase that was not properly recorded.

The time and energy spent on piecing together a paper trial that in the end is still incomplete and thus inaccurate is not only frustrating it can cause as loss of money or even legal implication.

Whether you are an individual or a business our approach works because we don’t stop at basic transaction recording. We help to find solutions for proving your transactional records by providing communication tools for insight and clarity into your financial transactions.

Our mission is to assist clients in achieving transparency and understanding by identifying effective communication solutions. We are dedicated to guiding our clients by providing the necessary knowledge to establish a consistent financial framework and interpret insights gained from solid data with clarity.

Our Approach to Accurate and Long-Term Success: Step by Step Frameworks built on a Strong Foundation

Our four-step transaction record keeping foundation plan for pursuing goals:

Step 1: Know you are not alone; this means never be afraid to ask

Step 2: Seek to learn, understand and practice healthy financial habits.

Step 3: Stay disciplined and focused.

Step 4: Continue to find ways to learn and understand: Staying informed and educated on laws and regulations

Because the biggest part of success is knowing what direction you are going.

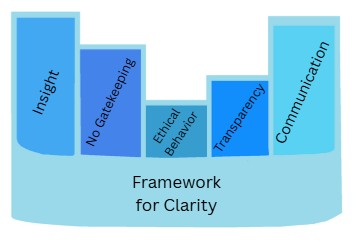

Framework – Internal Control Process

Insight – Clear and Accurate Date

Communication – Clear and Precise Reports

Clarity – Achieving transparency through effective frameworks in all financial dealings

Our core values: Ethical Behavior, Transparency, No Gatekeeping

Our six-step Framework for Strategy using Internal Control Processes for Long-Term Success:

Step 1: Decide your direction: What are your goals? How do you want to reach them?

Step 2: Make a plan for reaching your goals: Find or create your processes and systems that will help you reach your goals.

Step 3: Build healthy financial habits: Align your plan and your goals with your personal needs to achieve long-term success. If needed revise your plan or goal. This may mean you need to prepare for changes. You may need to seek help or support for accountability.

Step 4: Practice your plan: Create a schedule for maintaining, reviewing and updating your plan as needed.

Step 5: Seek avenues for financial growth: Find ways to add to your income and further stabilize your finances for your future.

Step 6: Once you find a new income generating idea: Repeat steps 1 thru 5: Continue growing by staying up to date with financial trends and decide how you will align your goals then adjust your plan, maintain or build new financial habits as needed, practice the new plan, always look for ways to grow financially whether with your current plan for income generation or new financial ventures.

Because the biggest part of long-term success is continuing the process of building upon a strong foundation.

Time and money are important when investing in your goals. Contact us today to help with tailored strategies to reach your long-term successful foundation and framework.